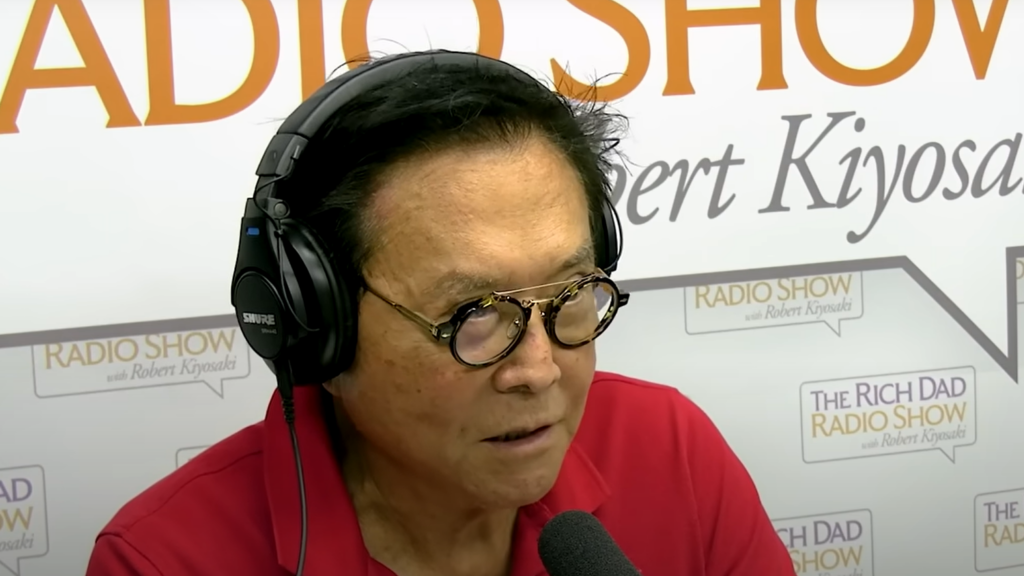

Despite the “get rich quicker” mentality,Kiyosaki’s books were revolutionary for me. They basically taught me that it’s impossible for the working class to get rich. You need to invest in either a business or real estate.

The missing part is that it’s practically impossible to invest in a business or real estate. You need vast amounts of capital or a loan with nearly zero interest. Oh and the ruling class has been sucking us dry for decades.

Still, his books are very valuable knowledge.

The part is greatly disliked about his books is how he glosses over the fact that he had a TON of resources at his disposal. A father figure that’s already in business, that tutored him specifically, gave him many connections in the business world, and also let him sit in on business meetings for nearly a decade. The man had more exposure, teaching, and connections than most business majors before he even set foot into the business world.

For a normal person that would take years of schooling and a really tough time making those connections and is an entirely unrealistic comparison.

TL;DR You are right, basically impossible for a normal person to achieve because the resources at his disposal.

There was a video I watched recently about how “this self taught developer did it the right way, follow his idea!”

He already worked in a high paying job that gave him the opportunity to design something for them and then they let him attend meetings to learn as much as possible from consultants they hired…

Ffs yeah if you start on 3rd base getting home isn’t the hardest thing to do…

It depends on the type of investing you want to do. The working class can absolutely invest in ETFs at varying risk profiles and build a retirement. They can’t drop $100k on an online startup and hope it explodes. They can invest in starting their own business.

It’s really hard to go from thousandaire to billionaire, but you can absolutely hit millionaire.

The working class can absolutely invest in ETFs at varying risk profiles and build a retirement.

Small investments that won’t grow very large, and all while struggling.

They can invest in starting their own business.

Most fail. It’s usually a poor investment.

You are so pointlessly negative. What they said is true. Those are the most common avenues for middle class to move classes.

I would call it realistic instead of negative.

Yeah, you can get rich through ETFs but it’s incredibly unlikely.

It’s incredibly likely that continously saving and investing for 30 years creates a decent retirement account.

Yes and highly recommended if you have the money to do so, but it’s not going to make you rich, and it’s certainly not going to pull you out of poverty.

That’s great but it’s also not really what most people would think of when someone is rich

No, it’s blaming poor people for being poor.

My wife is from a developing country so we invest through her family. I doubt we will ever be rich from it but it does add up. Obviously not an option for everyone but if it is for you might want to look into it.

I read about 1 page of that guy’s book years ago, pegged him as a scammer, and put the book back on the shelf. Looks like I got it right.

Another article says his net worth is 100m, so that would mean he might have 1.2b in debt but 1.3b in assets.

I’m not sure that suggests he’s a scammer on the surface.

Inside you there are two dads

Neither is a billion dollars in debt

One of them is a billion in debt. But the other one has a billion. Now I’m broke.

His two dads can’t make up their mind

His two dad’s should get a room

For a second, I thought maybe he was engaging in the popular tax avoidance strategy where you keep your investments in stocks, and then rather than sell them for liquid cash and pay capital gains tax, you take out low rate, interest-only loans using the value of the stock as collateral. It’s the sort of bullshit loophole available to the billionaire class to avoid paying their share of tax…

…but no, guy’s just leveraged up to his eyeballs in real estate and gold-buggery, and has the audacity to claim to be a finance guru.

Doesn’t believe in fiat currencies because they’re not real, but is all in on Bitcoin.

Old man going senile.

deleted by creator

If BTC is infinitely divisible, that distinction is meaningless

It’s not, it’s divisible down to 8 decimal places

I can just sell all my btc, start a new one(lemmicoin? Smuckbucks?), and start the grift over again.the first guy out the door as London bridge falls makes the most.

deleted by creator

For others…

If there are a maximum of 3000 coins and 2999 have been minted, and then instead of minting the last one, you mint 0.00000001

The total is still less than 3000. It’s 2999.00000001

You didn’t dilute the 3000 total, there isn’t 3000.00000001

This would require a hard fork to implement in Bitcoin, but it would follow the rules of never having more than 21 million coins.

For this to even be worth considering, BTC would have to have immense value to make altering the final halving worthwhile.

deleted by creator

Some might not understand that, but I think OP was talking about the 21 million limit not being a limit as I described. You said its limited, he said its infinitely divisible. The only way its infinite is if its hard forked as I described, otherwise there’s a hard limit of no division smaller than 1 Satoshi.

Good luck buying a pizza with your BTC lmao

You may have those reversed. BTC has a computational limit but countries can print as many bills as they like.

deleted by creator

There’s no cap to how much USD can be made, so noatter how much you have saved, it can be diluted down to nothing with enough time

This is a good thing, for many reasons.

deleted by creator

Yes it is, because it significantly encourages investment over saving, as one of the many benefits.

He’s the most huckstery of the major personal finance canon authors. And his book is pretty meh in comparison to like The Simple Path to Wealth or even I Will Teach You To Be Rich (which I have my own problems with). I feel like he just got in at the right time to go viral, he shouldn’t be famous based on the book itself.

I don’t get why people idolize him so much. Paying to go to seminars and such. Yes buy assets not liabilities, not complicated but he regularly pushes over leveraging yourself and working in the grey area of financial independence. Him and Ramsey provide good advice on targeted subjects but going all in and following these idols will lead to ruin for most.

How can he be rich if we don’t give him money?

iTT: People who think bankers got held accountable in 2008

*poor dad

I love this dude, he says some fucking weird ass shit.